Bitcoin needs fiat currency to keep on running

Last modified:

Bitcoin always needs more fiat currency to keep on running. And remember that this fiat currency is not invested in bitcoin itself, but lands in the pocket of the seller of bitcoin and in the pocket of the miners and the exchanges. Last year we have seen that bitcoin was valued at around the break-even point of about $16,000. We can use this to calculate approximately the amount of fiat currency currently needed to keep bitcoin running. There are 52,560 times 10 minutes in a year and at the current bitcoin mining rate of 6.25 per 10 minutes, we can come to the approximation of: 52,560 * 6.25 * $16,000 = $5,256,000,000 just to keep bitcoin running and processing transactions in one year currently.

Yes, that's right 5 billion dollar annually to keep bitcoin running currently at cost price. That is an insane amount of fiat currency that is needed. But miners want to profit from mining, so they take more than that. And then we have the exchanges as these aren't charitable institutions either. This is where bitcoin is a negative sum game, it always needs more fiat currency to keep on running, as costs is payed in real fiat currencies, not in funny money like stablecoins and bitcoin and the like.

So people speculating on the ever rising price of bitcoin give their money to the miners that sell the mined bitcoins or buy bitcoins from people and these bitcoin where bought on average at a much lower price. And remember, the first 50% of bitcoin where mined at low cost in the first 4 years of bitcoin. The cost price of bitcoin has increased insanely, but the average cost price of bitcoin will remain low, because of the halving and the cheap costs that bitcoin was mined at in the earlier years, in great numbers. This is the great Con!

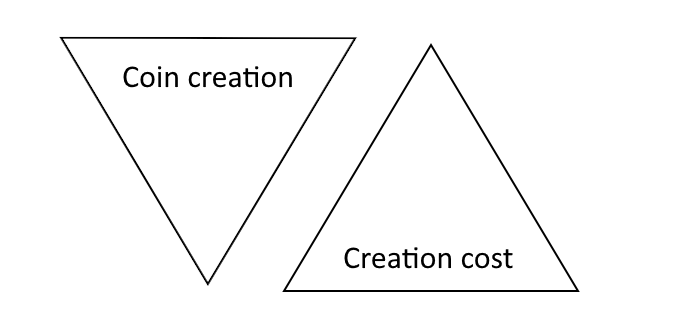

So, people buying into bitcoin should understand this, and how unequal the creation of bitcoin has been. And how unequal the costs of bitcoin have been divided. And also remember that the money is never invested anywhere but just lands in the pocket of the one who is selling these bitcoin. Remember the two triangles that I presented in my main article:

As I have mentioned in my main article, these pyramids don't even come close to the reality, because the reality is much worse.

Like any other Ponzi, bitcoin will fail if there isn't enough fiat currency used to buy bitcoin. People selling bitcoin are depended on the greater fool to buy theirs from them. Among these people are the miners, as they also need to sell their bitcoin, as they need fiat currency to pay their bills. Realizing this, it should be clear to see that this will eventually fail, and then it will become clear that bitcoin operated like a technically advanced Ponzi scheme, just as I have described in my main article.

Don't be fooled by higher bitcoin prices, as these can be manipulated. Especially stablecoins could be easily used to pump up the price. This can be done by creating unbacked stablecoins and by buying bitcoin with them. Then we get the trick that the creator of the stablecoin would say that these stablecoins are backed by these bitcoins. Again we see the Ponzi scheme lurking, this works only as long as people are willing to pay a higher price for bitcoin. If the creator of the stablecoin manages to pump bitcoin, it can then slowly sell/dump bitcoin at a higher price and they can then keep the price difference in their own pocket. This is risky business, because when people stop being fooled by these pump and dump schemes, it will all collapse.

Please remember that funny money like these stablecoins cannot pay for the costs of the miners. Liquidity of fiat currency will become an ever growing issue for bitcoin. It needs fiat currency to keep on running. But speculators in bitcoin might be persuaded to sell theirs for stablecoins, and stablecoins then might be exchanged for altcoins that are just created out of the blue, or 'rent' is payed on stablecoins, as these can be created on the fly. I hope you aren't fooled by this all, or that you will now at least start to realize why bitcoin is a grand Con.